Insurance Sales Automation: Automate Your Funnel in 2026

Amir Prodensky

CEO

Oct 3, 2025

11 min read

Practical steps to automate quotes, follow-ups, and renewals in 2026.

Insurance teams can’t rely on manual processes anymore.

Tracking leads in spreadsheets, juggling reminders, and manually following up with prospects slows the funnel and leaves opportunities on the table. Customers today expect instant responses, personalized conversations, and seamless service and if you can’t deliver – they’ll move on.

And the gap between rising customer expectations and outdated workflows is growing. Slow response times, missed calls, and inconsistent follow-ups all contribute to lost revenue and frustrated clients.

This is where tools like Strada, makes a difference. By automating outreach and follow-ups teams can focus on high-value conversations instead of repetitive tasks.

Because we’ve spent years helping teams streamline and automate their sales funnels, we know what actually works. And what doesn’t. This guide exists to give you a clear, ultra-practical roadmap.

No theory, just proven steps you can start using today. Here are the key things we’ll uncover together:

How to set up a modern insurance sales funnel that actually moves leads forward instead of letting them stall.

Which automation tools matter most for insurance teams in 2026 (and which ones you can skip).

How to attract, nurture, and qualify leads automatically, so you never lose momentum.

The right way to blend automation with human touch, so clients feel cared for, not spammed.

How to measure and improve your funnel over time without getting lost in data overload.

The biggest mistakes insurance teams make with automation and how you can avoid them.

By the end, you’ll have a clear playbook for building an insurance sales funnel that runs smoothly in the background, freeing your team to focus on closing deals and building relationships.

Let’s begin with the foundations.

What exactly is an insurance sales funnel?

An insurance sales funnel is the journey a prospect takes from first learning about your offerings to becoming a loyal customer. Like any funnel, it has stages that help teams understand where prospects are and how to engage them effectively.

Here are the core stages of the funnel:

Awareness → Prospects discover your company through marketing campaigns, referrals, or online search. In insurance, this might be the initial quote request or inquiry.

Interest → The prospect engages further asking questions, comparing options, or exploring coverage details.

Decision → Prospects weigh policies, costs, and value. Every interaction, from explaining policy benefits to handling objections, shapes their choice.

Action → The client buys a policy, completes payment, or signs documents.

Retention → Focus shifts to keeping customers happy through renewals and ongoing communication.

Each of these stages is a “conversation moment.”

This is exactly where Strada steps in. Its automation enhances every touchpoint: timely follow-ups, intelligent reminders, and seamless handoffs ensure no opportunity is missed. From quote intake to quote follow-ups and renewals, every interaction becomes consistent, proactive, and personalized.

Understanding the funnel, as the first step, helps highlight the gaps. Next, we’ll dive into why automation is essential to close leads faster and avoid missed opportunities.

Why should you automate your funnel?

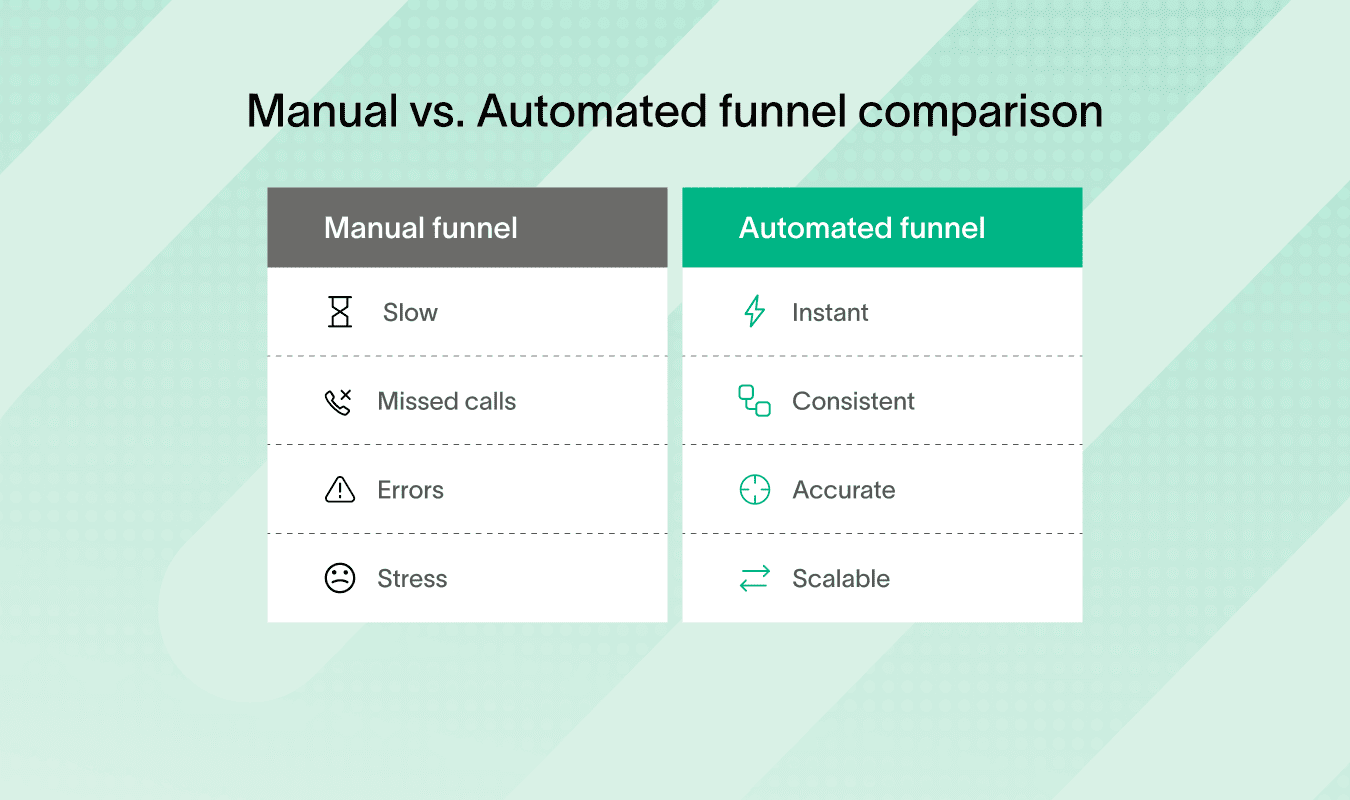

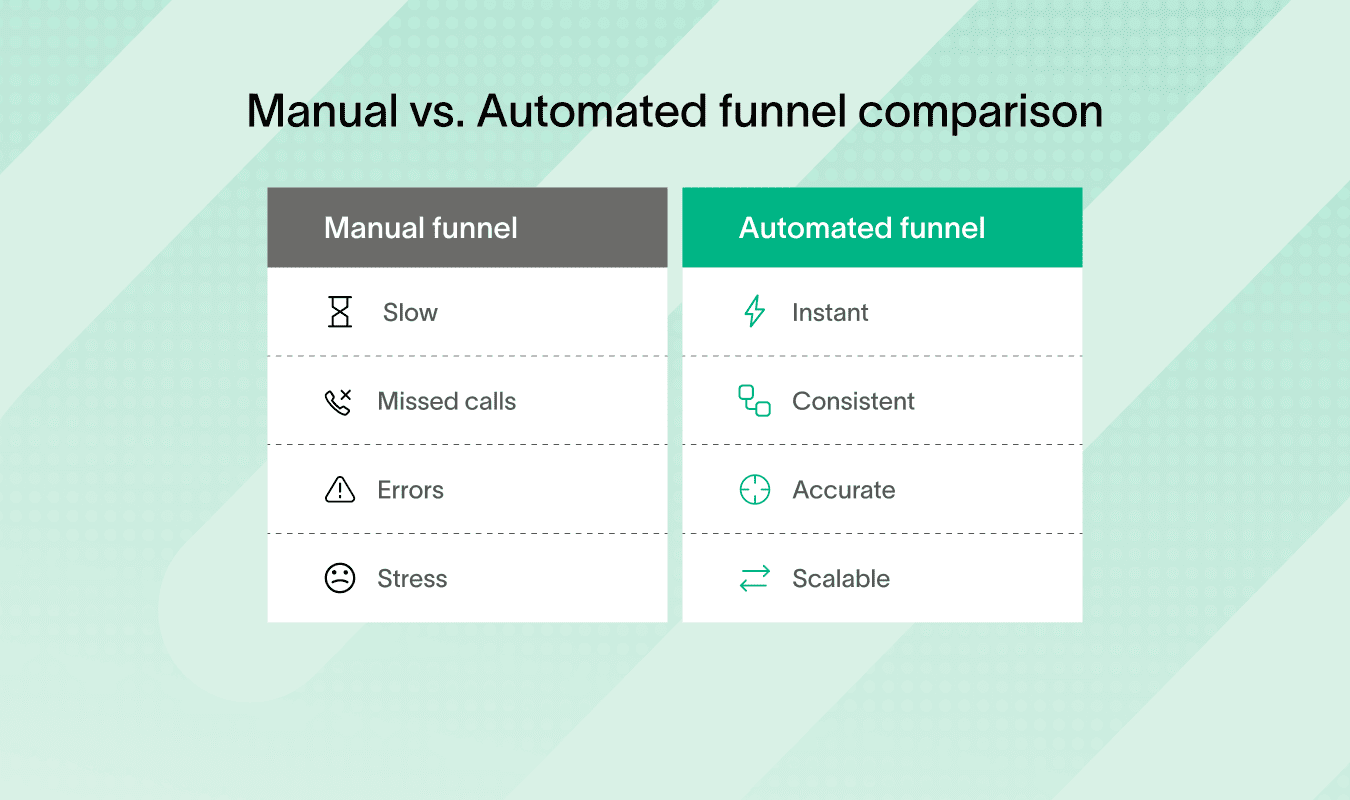

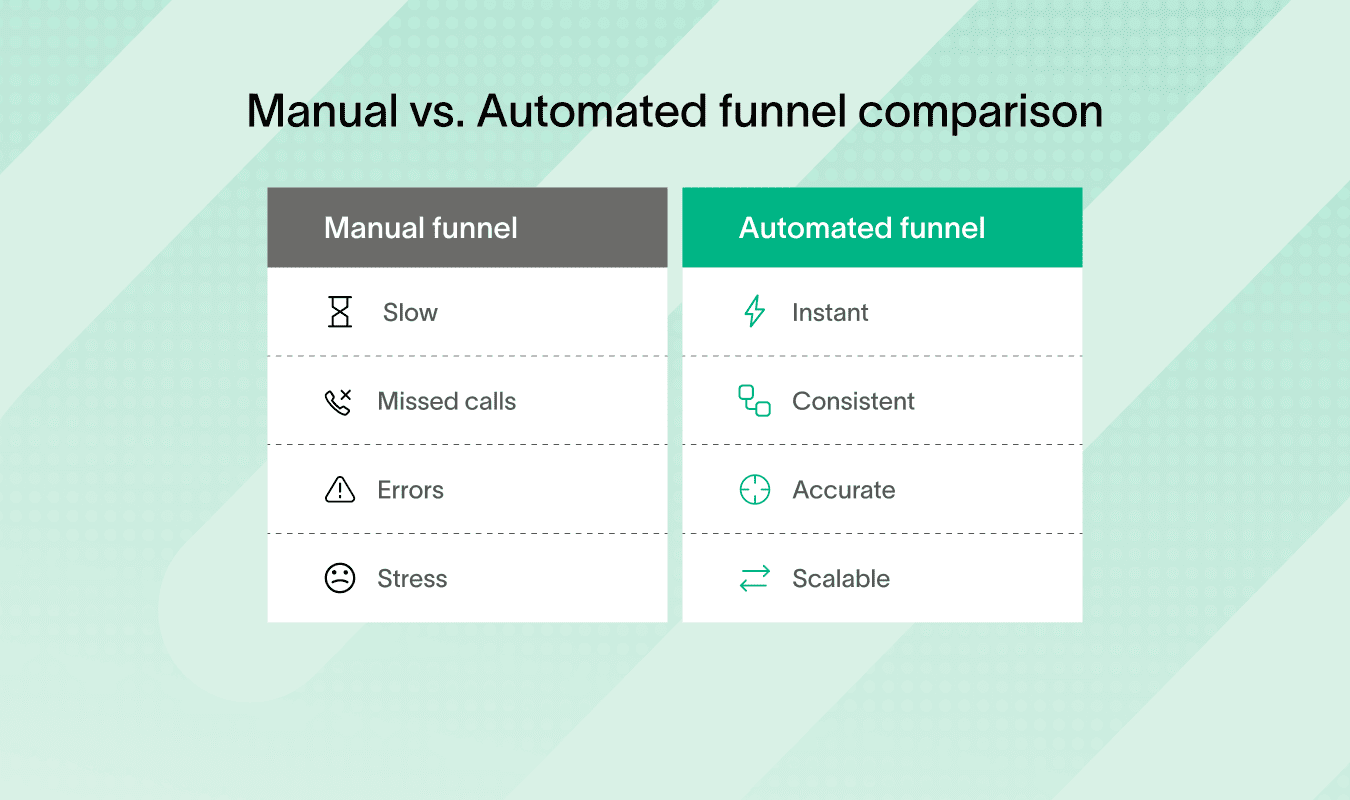

Manual insurance sales funnels are slow, error-prone, and costly. Agents spend hours tracking leads, sending reminders, and updating spreadsheets. This leads to missed calls, dropped leads, and slower renewals.

The result? Premium leakage from prospects who never hear back, policy lapses from payment reminders that never get sent, and delays from missing documentation.

Automating the funnel addresses these challenges directly. Here’s a quick side-by-side view.

A sales automation tool for insurance reduces manual work, saving agents’ time and allowing them to focus on meaningful conversations. Instead of chasing reminders or updating spreadsheets, automation handles the repetitive tasks that slow teams down.

With the right setup, you can:

Deliver instant outreach the moment a lead comes in, so no opportunity slips through the cracks.

Log every interaction automatically, ensuring a complete record without extra admin work.

Schedule and send follow-ups at the right time, without relying on memory or manual effort.

Score and segment leads, so your agents spend time on the prospects most likely to convert.

Trigger alerts and reminders, keeping your pipeline moving without bottlenecks.

Personalize communication at scale, so every message feels tailored, not templated.

Consistency is another benefit.

Customers experience the same reliable process at every touchpoint, quotes and renewals. Lead qualification improves because automation ensures prospects are nurtured intelligently based on behavior, risk, and engagement.

This leads to higher conversion rates and better retention.

Automation also prepares teams for the digital-first landscape of 2026. Competitors leveraging intelligent workflows will outpace those relying on manual processes. Efficiency, scalability, consistency, and compliance are all outcomes of a properly automated funnel.

Сhallange | Manual funnel outcome | Strada automation impact |

Lead follow-up | Missed calls, delayed responses | Automated reminders, 24/7 follow-ups, no lead left behind |

Policy renewals | Missed deadlines, lapses | Proactive reminders, streamlined process |

Agent workload | High manual effort, risk of errors | Reduced workload, focus on high-value conversations |

Compliance & Tracking | Hard to maintain, audit gaps | All actions logged automatically, secure and compliant |

Knowing the benefits is one thing, choosing the right tools is another. Let’s look at the software that makes automation effective.

What insurance sales software should you consider?

Modern insurance teams rely on a mix of tools to manage their sales funnel efficiently:

CRMs tailored for insurance agents help track leads, policyholders, and renewals in one place, providing visibility into every interaction and automating reminders.

Marketing automation software streamlines campaigns via email, SMS, and social media, delivering targeted messages based on behavior and engagement while freeing agents from repetitive tasks.

Chatbots and virtual assistants handle FAQs, quote requests, and policy updates instantly, providing 24/7 support and escalating complex cases to human agents.

AI-driven analytics and lead scoring tools identify high-potential prospects automatically, prioritize outreach, and help teams focus on opportunities with the highest conversion likelihood.

Integration platforms, including APIs and native connectors, tie all these systems together, ensuring data flows seamlessly and workflows are automated across the entire insurance sales process.

To see how everything connects, imagine your automation toolkit as one ecosystem. Each tool plays a role, but they all need to talk to each other:

Once you know the categories of automation tools the next question is: Which specific platforms should insurers actually consider? To make this easy, we’ve broken it down into a simple, decision-ready table.

Tool | Category | Key strengths | Best for | Why it matters |

Strada | Conversational AI / Phone Automation | AI phone agents, 24/7 renewals, quote intake, integrations with AMS/CRM, enterprise-grade security | Carriers, MGAs, Brokers | Eliminates missed calls, scales revenue-driving conversations, reduces E&O risk, infinitely scalable with zero engineering lift |

HubSpot | CRM + Marketing Automation | Lead tracking, automated email/SMS campaigns, pipeline dashboards | Small to mid-size agencies needing all-in-one CRM | Provides a central hub for sales + marketing with easy automation templates |

Salesforce Financial Services Cloud | CRM + Enterprise Sales Automation | Deep insurance CRM features, advanced analytics, AI-driven lead scoring | Larger insurers with complex pipelines | Highly customizable and integrates across enterprise systems |

AgencyBloc | Insurance Agency Management System | Policy management, commission tracking, automated workflows | Independent agencies & brokers | Purpose-built for insurance workflows, combines sales + back office |

Zapier / Make | Workflow Automation | Connects 5,000+ apps, automates data handoff between systems | Teams with multiple disconnected tools | Low-code way to bridge CRMs, dialers, and marketing platforms |

Drip / ActiveCampaign | Marketing Automation | Automated email nurturing, segmentation, personalization | Agencies needing drip campaigns | Keeps leads warm automatically with minimal manual effort |

Reply.io / Salesloft | Sales Engagement Platform | Multi-channel outreach (calls, email, SMS), sequencing, analytics, cadence automation | Insurance sales teams handling high lead volumes | Improves speed-to-lead, ensures consistent follow-ups, and provides insights into rep performance |

Tableau / Power BI | Analytics & Reporting | Visual dashboards, predictive modeling, integration with CRM/AMS | Insurance teams needing deep funnel insights | Transforms raw data into clear insights, helping teams track KPIs, spot bottlenecks, and optimize funnels |

As you can see, each tool plays a role in building a complete, automated funnel, from capturing leads to nurturing, closing, and measuring results.

And Strada fits into this ecosystem as a front-office AI layer that complements existing insurance operations software. Its phone AI agents handle revenue-driving calls for carriers, MGAs, and brokers, ensuring every conversation is structured, context-aware, and actionable.

Strada isn’t just generic call automation, it’s trained on insurance terminology and built specifically for renewals and COIs.

By automating routine conversations, Strada frees human agents for high-value tasks, while integrating with CRMs and AMS platforms to sync lead and renewal data automatically.

Teams choose Strada because it is purpose-built for insurance outcomes. It’s infinitely scalable, requires no engineering lift, and integrates seamlessly with Salesforce, AMS, CRMs, and APIs. Performance is measurable: 85% of calls answered, 24/7 availability, and more cost-effective than adding human agents. Proven results highlight its value.

Fernanda Soares, Senior Manager at Tint, says:

“Leveraging Strada as a foundation, we’ve created Aimee, our AI agent, to seamlessly complement our support team. It allows us to scale with confidence, while ensuring that trust, governance, and human expertise remain central.”

Here’s why Strada stands out:

Insurance-specific intelligence → Renewals, COIs, and quote intake handled correctly every time.

Scalable operations → Handle more calls, policies, and prospects without adding headcount.

Seamless integrations → Connects with all critical systems for real-time data capture.

Reliable performance → High call-answer rates, 24/7 availability, proactive workflows.

Immediate ROI → Less manual work, fewer errors, and more revenue opportunities captured.

Combined with other sales automation tools for insurance, Strada transforms the insurance sales process from reactive to proactive. Teams gain efficiency, consistency, and predictability, while customers enjoy timely, personalized interactions.

The result is a complete, intelligent, and efficient sales ecosystem that drives measurable results, boosts conversions, and scales operations effortlessly.

With the right tools in place, attracting leads becomes much easier. Here’s how Strada and other automation solutions drive prospects into your funnel.

How do you attract leads automatically?

Manual lead generation (cold calls, scattered emails, ad hoc social posts) wastes time and delivers inconsistent results. Insurance sales automation flips the script by letting technology do the heavy lifting, while your team focuses on conversations that close deals.

Here’s the step-by-step playbook to set up a fully automated, always-on lead engine.

Step 1: Lay the foundation (the plumbing)

Before you launch campaigns, you need the pipes in place. This ensures every lead flows into your system and no opportunity gets lost.

What to do:

Add Google, Meta, LinkedIn pixels to your site.

Standardize UTM tags for every campaign.

Connect forms, chatbots, and phone lines to your CRM/AMS (HubSpot, Salesforce, AgencyBloc).

Create an instant follow-up workflow: SMS + email + call.

Launch conversion-ready landing pages for each insurance line (auto, home, commercial, benefits).

Think of this as building the pipes of your funnel, without it, automation has nowhere to flow.

Step 2: Run targeted ads with smart retargeting

Ads are the fastest way to generate demand, but without automation they leak leads. Automation makes every click count.

What to do:

Run high-intent Google search campaigns and simple quote offers.

Use Meta/LinkedIn Lead Ads to capture top-of-funnel demand.

Build retargeting buckets (1–3 days, 7–14 days, 30 days).

Route every new lead to CRM + trigger instant SMS/Strada call.

Instead of chasing down cold prospects, automation ensures hot leads hear from you while they’re still paying attention.

Step 3: Use SEO + content to attract and nurture

Ads give you speed, but content builds staying power. Automation keeps content working long after you’ve published it.

What to do:

Create pillar pages for core insurance lines.

Add gated lead magnets (renewal checklists, coverage guides).

Auto-send assets + enroll leads in nurture drips.

Repurpose content into short videos + social snippets.

With automation, your content doesn’t just educate. It continuously feeds your funnel with fresh, qualified leads.

Step 4: Automate social media presence

Social media builds trust and awareness, but posting daily is unsustainable. Automation keeps you visible without the grind.

What to do:

Schedule content across LinkedIn, Facebook, Instagram.

Use auto-DM triggers (“Comment QUOTE”) to capture info.

Sync DMs/comments into CRM automatically.

Retarget engagers with ads and nurture flows.

Instead of chasing likes, your social presence becomes a lead capture engine running on autopilot.

Step 5: Scale with referral + affiliate programs

Happy customers are your best marketers. Automation turns goodwill into a predictable stream of new business.

What to do:

Launch with ReferralRock/PartnerStack.

Offer simple rewards (gift cards, credits, rev-share).

Trigger referral invites after renewals or high NPS scores.

Auto-route referral leads into a priority queue with instant follow-up.

Instead of one-off word of mouth, referrals become a repeatable, measurable acquisition channel.

Step 6: Engage at scale with sales engagement tools

Consistency wins in sales, but it’s nearly impossible manually. Sales engagement tools automate the sequences that keep leads moving forward.

What to do:

Build multi-channel cadences (call with Strada + email + SMS with Strada).

Segment sequences by product line or persona.

Track engagement analytics to refine messaging.

Sync outreach with your CRM so no activity is lost.

These platforms ensures every prospect gets the right number of touches at the right time, without relying on memory or sticky notes.

Step 7: Supercharge conversations with Strada

The phone is still central to insurance conversations. Strada’s conversational AI ensures quote and renewal calls happen instantly, accurately, and at scale.

What to do:

Deploy AI phone agents for quote intake and renewals.

Trigger outbound calls the moment a new lead arrives.

Log calls + transcripts back into CRM/AMS automatically.

Use intelligent retries + caller ID optimization to maximize pickup rates.

With Strada, phone conversations (the lifeblood of insurance sales) become faster, smarter, and infinitely scalable.

Step 8: Track with analytics + feedback loops

What gets measured gets improved. Analytics tools turn your funnel from a black box into a predictable growth engine.

What to do:

Use Tableau/Power BI for dashboards and predictive insights.

Track cost per lead, speed-to-lead, contact rates, and closed policies.

Push closed-won data back into ad platforms for smarter targeting.

Review funnels every 90 days and refine.

With analytics in place, you’re not guessing which campaigns work. You know exactly where to double down.

The result: a system where ads, content, social, referrals, outreach, and Strada all connect into one automated funnel with your insurance sales software. Leads flow in, conversations happen instantly, and your team focuses only on what matters: closing business.

Capturing leads is just the start. Next, you’ll see how to nurture them automatically, keeping prospects engaged until they’re ready to buy.

How can you nurture leads without manual follow-up?

Manual follow-up is time-consuming and inconsistent. Leads can easily slip through the cracks if agents are busy or reminders are forgotten.

Automation solves this problem, allowing teams to nurture prospects efficiently and consistently while freeing up time for high-value conversations.

The first step is to replace scattered, manual follow-up with reliable, automated outreach that touches leads wherever they are.

Email drips → Build short sequences (5–7 emails) triggered by actions like downloading a guide or starting a quote. Mix education, testimonials, and gentle calls-to-action.

SMS and push nudges → Use quick reminders (“Finish your quote in 2 minutes”) or updates (“Your renewal date is coming up”) to keep leads engaged.

Content delivery → Auto-send guides, FAQs, or calculators based on behavior (e.g., someone visiting your “renewals” page gets a renewal checklist).

Once your outreach runs automatically, the next step is to make sure each message feels relevant, because personalization drives response.

AI segmentation enhances effectiveness by grouping leads based on: behavior, engagement, and risk. Each segment receives tailored messaging, improving the likelihood of conversion. Combining email and text automation with Strada’s conversational AI takes nurturing even further.

The system can call, follow up, and engage prospects intelligently, turning passive leads into active conversations.

A common example is abandoned quote recovery. When a prospect doesn’t complete a quote, Strada Workflows automatically:

Schedules follow-up outreach

Creates agent reminders

Updates lead status in the CRM

This ensures no opportunity is lost, while maintaining a proactive and personalized approach.

Conversational reminders, education sequences, and proactive engagement keep leads moving through the funnel automatically. The combination of automation and AI not only improves efficiency but also creates a consistent, high-quality experience that builds trust and accelerates decision-making.

Nurtured leads need to be qualified efficiently. Let’s explore scoring, pre-qualification, and prioritization with automation.

How do you qualify leads with insurance sales automation?

Matter-of-factly, not all leads are created equal.

Qualifying them quickly and accurately ensures agents focus on prospects most likely to convert. Insurance sales automation makes lead qualification efficient, consistent, and data-driven.

The foundation of smart qualification is a scoring model that ranks leads by how likely they are to convert.

Set scoring rules → Award points for demographics (business size, zip code), behaviors (form completions, quote requests), and intent signals (pricing page visits, renewal searches).

Use thresholds → Leads above a certain score get routed immediately to sales, while others stay in nurture campaigns.

Refine continuously → Adjust weightings every quarter based on actual closed-won data.

Think of qualification like a ladder. Each rung tells you how ready a lead is. The higher they climb, the closer they are to a policy:

A website chatbot can instantly gather coverage needs, policy types, and contact details, while a phone-based AI like Strada can handle quote intake conversations in real time.

This means prospects are pre-qualified before an agent ever picks up the phone. Instead of asking basic questions, producers enter conversations with context, ready to advise and close.

Qualification isn’t complete until every signal is unified across your systems. Sales automation for insurance makes this seamless by pulling data from web forms, emails, SMS, and calls into one CRM record.

Hot leads can then trigger automated workflows: instant alerts to reps, priority task assignments, or even a proactive Strada callback.

For prospects, the experience is smoother = no repeating information across channels, no delays in response, just fast, relevant engagement.

Here’s how automation makes qualification smoother:

Lead scoring models → Rank prospects based on intent and behavior.

Chatbots → Collect essential details before agents engage.

Data sync → Unify information across systems.

Trigger-based workflows → Flag hot leads instantly and assign tasks.

By combining scoring, AI-powered pre-qualification, and automated workflows, teams can maximize conversion potential while reducing manual work. Leads move through the funnel faster, agents focus on meaningful conversations, and every prospect receives a timely, personalized response.

Once leads are qualified, it’s time to close deals. Here’s how automation speeds up B2B insurance sales from first contact to signed contract.

How can you close B2B insurance sales faster with automation?

Closing B2B insurance sales doesn’t need to drag on with endless back-and-forth emails, paperwork, and delays. The key is automating the steps that usually eat up time, so agents can focus on building trust and moving deals forward.

Here’s how to do it.

Step 1: Automate scheduling and reminders

Scheduling meetings is often the first bottleneck. Endless email exchanges and missed calls slow deals down. Automation removes this friction.

Use tools like Calendly or HubSpot Meetings so prospects book directly into your calendar.

Add automated reminders by email or SMS to cut down on no-shows.

With Strada, let prospects even schedule inside the call (“schedule conversationally”), so nothing slips.

Once scheduling runs itself, you can focus on the next major delay: paperwork and signatures.

Step 2: Streamline proposals and signatures

The second slowdown comes when it’s time to prepare, send, and sign documents. Automation turns this into a fast, seamless process.

Send digital proposals instead of paper, so no printing, scanning, or mailing.

Enable e-signatures (DocuSign, PandaDoc, HubSpot Quotes) so approvals happen in minutes.

Use AI-assisted quote generation to deliver accurate proposals fast, with risks flagged automatically.

With documents handled smoothly, you’re ready to tackle the next challenge – responding in real time when client needs change.

Step 3: React in real time with AI workflows

Customer conversations are full of signals: some showing urgency, others signaling churn. Automation with Strada ensures you never miss them.

During calls, Strada listens for risk signals (e.g., “I found a cheaper rate”) and instantly creates retention tasks.

Set trigger-based workflows in your CRM and/or AMS to alert the right rep or escalate priority accounts.

Automate next steps (follow-up emails, call scheduling, or renewal reminders), so no lead is left unattended.

With smart workflows in place, your sales team doesn’t just move faster. They react smarter, turning risks into opportunities.

Step 4: Spend time where it matters

The real goal of automation isn’t just speed. It’s freeing agents to do what technology can’t: build trust and close deals.

With scheduling, documents, and workflows automated, sales teams can focus on high-value conversations, not admin work. Every touchpoint (booking, quoting, signing) is faster, more efficient, and tracked automatically.

Closing the deal isn’t the end. Next, we’ll see how automation keeps customers happy.

What happens after the sale?

The sale isn’t the end – it’s the start of retention, loyalty, and growth. Strada keeps customers supported after day one by automating the critical post-sale touchpoints that often slow insurance teams down.

Onboarding made easy → Strada ensures new policyholders get welcome calls, documents, and account setup instantly. No manual chasing.

Seamless renewals → Strada handles proactive renewal reminders and conversational scheduling, reducing churn and keeping clients engaged.

Ongoing support & COIs → From certificate requests to renewal reminders, Strada provides quick responses and updates through automation.

Instead of scrambling with manual tasks, your team stays focused on value-driven conversations while Strada handles the rest. Post-sale processes become consistent, proactive, and customer-friendly – building satisfaction and long-term loyalty.

Once the workflows are running smoothly, it’s time to measure results and optimize.

How do you measure success and improve?

You can’t improve what you don’t measure. In insurance sales management, tracking the right metrics shows you where your funnel is strong and where it leaks.

Here are the main metrics:

Metric | What it means | Benchmark (insurance sales) |

Lead-to-quote conversion | % of leads who request/receive a quote | 20–30% |

Quote-to-bind conversion | % of quotes that turn into active policies | 25–35% (personal lines), 15–25% (commercial lines) |

Cost per lead (CPL) | Average spend to generate one lead | $40–100 (personal), $150–300 (commercial) |

Speed-to-lead | Time from lead creation to first contact | < 5 minutes (best-in-class) |

No-show rate | % of prospects who miss scheduled meetings | < 15% with reminders |

Renewal rate | % of clients renewing policies each year | 85–90%+ |

Retention/Churn | % of customers who stay vs. leave | Retention 85%+; Churn < 15% |

Customer satisfaction (CSAT/NPS) | Client-reported satisfaction score | CSAT: 80%+ / NPS: 30+ |

Tracking these allows teams to identify what’s working, where gaps exist, and how resources should be allocated. Still, metrics are critical, but mistakes can still derail results.

Let’s cover common pitfalls and how to avoid them.

What mistakes should you avoid when implementing insurance sales automation?

Automation makes insurance sales faster and more consistent, but only if it’s done right. Here are the most common pitfalls to watch for:

Over-automation → Not every task should be handled by AI. Complex cases and relationship-driven conversations still need a human touch.

Bad data → Outdated or incomplete information ruins campaigns and frustrates clients. Keep your CRM/AMS clean and synced.

Ignoring compliance → Insurance is heavily regulated. Using tools without strong security and certifications creates risk.

Missing integrations → If automation doesn’t connect to your CRM, AMS, or billing system, you’re just adding more manual work.

Avoid these mistakes, and automation becomes a growth engine, helping your team close more policies, serve clients better, and stay compliant without losing the human touch.

After mastering today’s sales automation for insurance, it’s clear how teams can scale efficiently and stay ahead. Let’s wrap up with key takeaways.

Conclusion

Insurance sales are changing fast. What used to take days (chasing quotes, scheduling calls, tracking renewals) can now happen in minutes with automation. The teams that adapt will close more deals, keep more clients, and deliver a better experience.

The ones that don’t will keep losing opportunities to speed, consistency, and customer expectations.

Strada helps insurance teams make that shift. By automating the calls, follow-ups, and renewals that slow funnels down, Strada ensures every lead is nurtured and every client feels supported, while agents focus on the conversations that really matter.

Automation isn’t about replacing people. It’s about giving your team the tools to work smarter, move faster, and stay competitive in 2026 and beyond.

If you’re ready to see how voice AI can transform your insurance conversations and workflows, join the carriers, MGAs, and brokers already scaling with Strada.

Get a demo and experience the future of insurance communication firsthand.

Frequently Asked Questions

How does automation reduce errors in insurance sales processes?

Automating insurance sales software minimizes human mistakes by handling repetitive tasks precisely. When data entry and document generation are automated, the risk of clerical errors drops significantly, improving overall accuracy and compliance.

What impact does automation have on customer response times?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How does automation improve lead management for insurance agents?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How can small insurance agencies benefit from sales automation?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How should an insurance company start automating its sales funnel in 2026?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

Table of Contents

Carriers, MGAs, and brokers scale revenue-driving phone calls with Strada's conversational AI platform.

Start scaling with voice AI agents today

Join innovative carriers and MGAs transforming their calls with Strada.

Insurance Sales Automation: Automate Your Funnel in 2026

Amir Prodensky

CEO

Oct 3, 2025

11 min read

Practical steps to automate quotes, follow-ups, and renewals in 2026.

Insurance teams can’t rely on manual processes anymore.

Tracking leads in spreadsheets, juggling reminders, and manually following up with prospects slows the funnel and leaves opportunities on the table. Customers today expect instant responses, personalized conversations, and seamless service and if you can’t deliver – they’ll move on.

And the gap between rising customer expectations and outdated workflows is growing. Slow response times, missed calls, and inconsistent follow-ups all contribute to lost revenue and frustrated clients.

This is where tools like Strada, makes a difference. By automating outreach and follow-ups teams can focus on high-value conversations instead of repetitive tasks.

Because we’ve spent years helping teams streamline and automate their sales funnels, we know what actually works. And what doesn’t. This guide exists to give you a clear, ultra-practical roadmap.

No theory, just proven steps you can start using today. Here are the key things we’ll uncover together:

How to set up a modern insurance sales funnel that actually moves leads forward instead of letting them stall.

Which automation tools matter most for insurance teams in 2026 (and which ones you can skip).

How to attract, nurture, and qualify leads automatically, so you never lose momentum.

The right way to blend automation with human touch, so clients feel cared for, not spammed.

How to measure and improve your funnel over time without getting lost in data overload.

The biggest mistakes insurance teams make with automation and how you can avoid them.

By the end, you’ll have a clear playbook for building an insurance sales funnel that runs smoothly in the background, freeing your team to focus on closing deals and building relationships.

Let’s begin with the foundations.

What exactly is an insurance sales funnel?

An insurance sales funnel is the journey a prospect takes from first learning about your offerings to becoming a loyal customer. Like any funnel, it has stages that help teams understand where prospects are and how to engage them effectively.

Here are the core stages of the funnel:

Awareness → Prospects discover your company through marketing campaigns, referrals, or online search. In insurance, this might be the initial quote request or inquiry.

Interest → The prospect engages further asking questions, comparing options, or exploring coverage details.

Decision → Prospects weigh policies, costs, and value. Every interaction, from explaining policy benefits to handling objections, shapes their choice.

Action → The client buys a policy, completes payment, or signs documents.

Retention → Focus shifts to keeping customers happy through renewals and ongoing communication.

Each of these stages is a “conversation moment.”

This is exactly where Strada steps in. Its automation enhances every touchpoint: timely follow-ups, intelligent reminders, and seamless handoffs ensure no opportunity is missed. From quote intake to quote follow-ups and renewals, every interaction becomes consistent, proactive, and personalized.

Understanding the funnel, as the first step, helps highlight the gaps. Next, we’ll dive into why automation is essential to close leads faster and avoid missed opportunities.

Why should you automate your funnel?

Manual insurance sales funnels are slow, error-prone, and costly. Agents spend hours tracking leads, sending reminders, and updating spreadsheets. This leads to missed calls, dropped leads, and slower renewals.

The result? Premium leakage from prospects who never hear back, policy lapses from payment reminders that never get sent, and delays from missing documentation.

Automating the funnel addresses these challenges directly. Here’s a quick side-by-side view.

A sales automation tool for insurance reduces manual work, saving agents’ time and allowing them to focus on meaningful conversations. Instead of chasing reminders or updating spreadsheets, automation handles the repetitive tasks that slow teams down.

With the right setup, you can:

Deliver instant outreach the moment a lead comes in, so no opportunity slips through the cracks.

Log every interaction automatically, ensuring a complete record without extra admin work.

Schedule and send follow-ups at the right time, without relying on memory or manual effort.

Score and segment leads, so your agents spend time on the prospects most likely to convert.

Trigger alerts and reminders, keeping your pipeline moving without bottlenecks.

Personalize communication at scale, so every message feels tailored, not templated.

Consistency is another benefit.

Customers experience the same reliable process at every touchpoint, quotes and renewals. Lead qualification improves because automation ensures prospects are nurtured intelligently based on behavior, risk, and engagement.

This leads to higher conversion rates and better retention.

Automation also prepares teams for the digital-first landscape of 2026. Competitors leveraging intelligent workflows will outpace those relying on manual processes. Efficiency, scalability, consistency, and compliance are all outcomes of a properly automated funnel.

Сhallange | Manual funnel outcome | Strada automation impact |

Lead follow-up | Missed calls, delayed responses | Automated reminders, 24/7 follow-ups, no lead left behind |

Policy renewals | Missed deadlines, lapses | Proactive reminders, streamlined process |

Agent workload | High manual effort, risk of errors | Reduced workload, focus on high-value conversations |

Compliance & Tracking | Hard to maintain, audit gaps | All actions logged automatically, secure and compliant |

Knowing the benefits is one thing, choosing the right tools is another. Let’s look at the software that makes automation effective.

What insurance sales software should you consider?

Modern insurance teams rely on a mix of tools to manage their sales funnel efficiently:

CRMs tailored for insurance agents help track leads, policyholders, and renewals in one place, providing visibility into every interaction and automating reminders.

Marketing automation software streamlines campaigns via email, SMS, and social media, delivering targeted messages based on behavior and engagement while freeing agents from repetitive tasks.

Chatbots and virtual assistants handle FAQs, quote requests, and policy updates instantly, providing 24/7 support and escalating complex cases to human agents.

AI-driven analytics and lead scoring tools identify high-potential prospects automatically, prioritize outreach, and help teams focus on opportunities with the highest conversion likelihood.

Integration platforms, including APIs and native connectors, tie all these systems together, ensuring data flows seamlessly and workflows are automated across the entire insurance sales process.

To see how everything connects, imagine your automation toolkit as one ecosystem. Each tool plays a role, but they all need to talk to each other:

Once you know the categories of automation tools the next question is: Which specific platforms should insurers actually consider? To make this easy, we’ve broken it down into a simple, decision-ready table.

Tool | Category | Key strengths | Best for | Why it matters |

Strada | Conversational AI / Phone Automation | AI phone agents, 24/7 renewals, quote intake, integrations with AMS/CRM, enterprise-grade security | Carriers, MGAs, Brokers | Eliminates missed calls, scales revenue-driving conversations, reduces E&O risk, infinitely scalable with zero engineering lift |

HubSpot | CRM + Marketing Automation | Lead tracking, automated email/SMS campaigns, pipeline dashboards | Small to mid-size agencies needing all-in-one CRM | Provides a central hub for sales + marketing with easy automation templates |

Salesforce Financial Services Cloud | CRM + Enterprise Sales Automation | Deep insurance CRM features, advanced analytics, AI-driven lead scoring | Larger insurers with complex pipelines | Highly customizable and integrates across enterprise systems |

AgencyBloc | Insurance Agency Management System | Policy management, commission tracking, automated workflows | Independent agencies & brokers | Purpose-built for insurance workflows, combines sales + back office |

Zapier / Make | Workflow Automation | Connects 5,000+ apps, automates data handoff between systems | Teams with multiple disconnected tools | Low-code way to bridge CRMs, dialers, and marketing platforms |

Drip / ActiveCampaign | Marketing Automation | Automated email nurturing, segmentation, personalization | Agencies needing drip campaigns | Keeps leads warm automatically with minimal manual effort |

Reply.io / Salesloft | Sales Engagement Platform | Multi-channel outreach (calls, email, SMS), sequencing, analytics, cadence automation | Insurance sales teams handling high lead volumes | Improves speed-to-lead, ensures consistent follow-ups, and provides insights into rep performance |

Tableau / Power BI | Analytics & Reporting | Visual dashboards, predictive modeling, integration with CRM/AMS | Insurance teams needing deep funnel insights | Transforms raw data into clear insights, helping teams track KPIs, spot bottlenecks, and optimize funnels |

As you can see, each tool plays a role in building a complete, automated funnel, from capturing leads to nurturing, closing, and measuring results.

And Strada fits into this ecosystem as a front-office AI layer that complements existing insurance operations software. Its phone AI agents handle revenue-driving calls for carriers, MGAs, and brokers, ensuring every conversation is structured, context-aware, and actionable.

Strada isn’t just generic call automation, it’s trained on insurance terminology and built specifically for renewals and COIs.

By automating routine conversations, Strada frees human agents for high-value tasks, while integrating with CRMs and AMS platforms to sync lead and renewal data automatically.

Teams choose Strada because it is purpose-built for insurance outcomes. It’s infinitely scalable, requires no engineering lift, and integrates seamlessly with Salesforce, AMS, CRMs, and APIs. Performance is measurable: 85% of calls answered, 24/7 availability, and more cost-effective than adding human agents. Proven results highlight its value.

Fernanda Soares, Senior Manager at Tint, says:

“Leveraging Strada as a foundation, we’ve created Aimee, our AI agent, to seamlessly complement our support team. It allows us to scale with confidence, while ensuring that trust, governance, and human expertise remain central.”

Here’s why Strada stands out:

Insurance-specific intelligence → Renewals, COIs, and quote intake handled correctly every time.

Scalable operations → Handle more calls, policies, and prospects without adding headcount.

Seamless integrations → Connects with all critical systems for real-time data capture.

Reliable performance → High call-answer rates, 24/7 availability, proactive workflows.

Immediate ROI → Less manual work, fewer errors, and more revenue opportunities captured.

Combined with other sales automation tools for insurance, Strada transforms the insurance sales process from reactive to proactive. Teams gain efficiency, consistency, and predictability, while customers enjoy timely, personalized interactions.

The result is a complete, intelligent, and efficient sales ecosystem that drives measurable results, boosts conversions, and scales operations effortlessly.

With the right tools in place, attracting leads becomes much easier. Here’s how Strada and other automation solutions drive prospects into your funnel.

How do you attract leads automatically?

Manual lead generation (cold calls, scattered emails, ad hoc social posts) wastes time and delivers inconsistent results. Insurance sales automation flips the script by letting technology do the heavy lifting, while your team focuses on conversations that close deals.

Here’s the step-by-step playbook to set up a fully automated, always-on lead engine.

Step 1: Lay the foundation (the plumbing)

Before you launch campaigns, you need the pipes in place. This ensures every lead flows into your system and no opportunity gets lost.

What to do:

Add Google, Meta, LinkedIn pixels to your site.

Standardize UTM tags for every campaign.

Connect forms, chatbots, and phone lines to your CRM/AMS (HubSpot, Salesforce, AgencyBloc).

Create an instant follow-up workflow: SMS + email + call.

Launch conversion-ready landing pages for each insurance line (auto, home, commercial, benefits).

Think of this as building the pipes of your funnel, without it, automation has nowhere to flow.

Step 2: Run targeted ads with smart retargeting

Ads are the fastest way to generate demand, but without automation they leak leads. Automation makes every click count.

What to do:

Run high-intent Google search campaigns and simple quote offers.

Use Meta/LinkedIn Lead Ads to capture top-of-funnel demand.

Build retargeting buckets (1–3 days, 7–14 days, 30 days).

Route every new lead to CRM + trigger instant SMS/Strada call.

Instead of chasing down cold prospects, automation ensures hot leads hear from you while they’re still paying attention.

Step 3: Use SEO + content to attract and nurture

Ads give you speed, but content builds staying power. Automation keeps content working long after you’ve published it.

What to do:

Create pillar pages for core insurance lines.

Add gated lead magnets (renewal checklists, coverage guides).

Auto-send assets + enroll leads in nurture drips.

Repurpose content into short videos + social snippets.

With automation, your content doesn’t just educate. It continuously feeds your funnel with fresh, qualified leads.

Step 4: Automate social media presence

Social media builds trust and awareness, but posting daily is unsustainable. Automation keeps you visible without the grind.

What to do:

Schedule content across LinkedIn, Facebook, Instagram.

Use auto-DM triggers (“Comment QUOTE”) to capture info.

Sync DMs/comments into CRM automatically.

Retarget engagers with ads and nurture flows.

Instead of chasing likes, your social presence becomes a lead capture engine running on autopilot.

Step 5: Scale with referral + affiliate programs

Happy customers are your best marketers. Automation turns goodwill into a predictable stream of new business.

What to do:

Launch with ReferralRock/PartnerStack.

Offer simple rewards (gift cards, credits, rev-share).

Trigger referral invites after renewals or high NPS scores.

Auto-route referral leads into a priority queue with instant follow-up.

Instead of one-off word of mouth, referrals become a repeatable, measurable acquisition channel.

Step 6: Engage at scale with sales engagement tools

Consistency wins in sales, but it’s nearly impossible manually. Sales engagement tools automate the sequences that keep leads moving forward.

What to do:

Build multi-channel cadences (call with Strada + email + SMS with Strada).

Segment sequences by product line or persona.

Track engagement analytics to refine messaging.

Sync outreach with your CRM so no activity is lost.

These platforms ensures every prospect gets the right number of touches at the right time, without relying on memory or sticky notes.

Step 7: Supercharge conversations with Strada

The phone is still central to insurance conversations. Strada’s conversational AI ensures quote and renewal calls happen instantly, accurately, and at scale.

What to do:

Deploy AI phone agents for quote intake and renewals.

Trigger outbound calls the moment a new lead arrives.

Log calls + transcripts back into CRM/AMS automatically.

Use intelligent retries + caller ID optimization to maximize pickup rates.

With Strada, phone conversations (the lifeblood of insurance sales) become faster, smarter, and infinitely scalable.

Step 8: Track with analytics + feedback loops

What gets measured gets improved. Analytics tools turn your funnel from a black box into a predictable growth engine.

What to do:

Use Tableau/Power BI for dashboards and predictive insights.

Track cost per lead, speed-to-lead, contact rates, and closed policies.

Push closed-won data back into ad platforms for smarter targeting.

Review funnels every 90 days and refine.

With analytics in place, you’re not guessing which campaigns work. You know exactly where to double down.

The result: a system where ads, content, social, referrals, outreach, and Strada all connect into one automated funnel with your insurance sales software. Leads flow in, conversations happen instantly, and your team focuses only on what matters: closing business.

Capturing leads is just the start. Next, you’ll see how to nurture them automatically, keeping prospects engaged until they’re ready to buy.

How can you nurture leads without manual follow-up?

Manual follow-up is time-consuming and inconsistent. Leads can easily slip through the cracks if agents are busy or reminders are forgotten.

Automation solves this problem, allowing teams to nurture prospects efficiently and consistently while freeing up time for high-value conversations.

The first step is to replace scattered, manual follow-up with reliable, automated outreach that touches leads wherever they are.

Email drips → Build short sequences (5–7 emails) triggered by actions like downloading a guide or starting a quote. Mix education, testimonials, and gentle calls-to-action.

SMS and push nudges → Use quick reminders (“Finish your quote in 2 minutes”) or updates (“Your renewal date is coming up”) to keep leads engaged.

Content delivery → Auto-send guides, FAQs, or calculators based on behavior (e.g., someone visiting your “renewals” page gets a renewal checklist).

Once your outreach runs automatically, the next step is to make sure each message feels relevant, because personalization drives response.

AI segmentation enhances effectiveness by grouping leads based on: behavior, engagement, and risk. Each segment receives tailored messaging, improving the likelihood of conversion. Combining email and text automation with Strada’s conversational AI takes nurturing even further.

The system can call, follow up, and engage prospects intelligently, turning passive leads into active conversations.

A common example is abandoned quote recovery. When a prospect doesn’t complete a quote, Strada Workflows automatically:

Schedules follow-up outreach

Creates agent reminders

Updates lead status in the CRM

This ensures no opportunity is lost, while maintaining a proactive and personalized approach.

Conversational reminders, education sequences, and proactive engagement keep leads moving through the funnel automatically. The combination of automation and AI not only improves efficiency but also creates a consistent, high-quality experience that builds trust and accelerates decision-making.

Nurtured leads need to be qualified efficiently. Let’s explore scoring, pre-qualification, and prioritization with automation.

How do you qualify leads with insurance sales automation?

Matter-of-factly, not all leads are created equal.

Qualifying them quickly and accurately ensures agents focus on prospects most likely to convert. Insurance sales automation makes lead qualification efficient, consistent, and data-driven.

The foundation of smart qualification is a scoring model that ranks leads by how likely they are to convert.

Set scoring rules → Award points for demographics (business size, zip code), behaviors (form completions, quote requests), and intent signals (pricing page visits, renewal searches).

Use thresholds → Leads above a certain score get routed immediately to sales, while others stay in nurture campaigns.

Refine continuously → Adjust weightings every quarter based on actual closed-won data.

Think of qualification like a ladder. Each rung tells you how ready a lead is. The higher they climb, the closer they are to a policy:

A website chatbot can instantly gather coverage needs, policy types, and contact details, while a phone-based AI like Strada can handle quote intake conversations in real time.

This means prospects are pre-qualified before an agent ever picks up the phone. Instead of asking basic questions, producers enter conversations with context, ready to advise and close.

Qualification isn’t complete until every signal is unified across your systems. Sales automation for insurance makes this seamless by pulling data from web forms, emails, SMS, and calls into one CRM record.

Hot leads can then trigger automated workflows: instant alerts to reps, priority task assignments, or even a proactive Strada callback.

For prospects, the experience is smoother = no repeating information across channels, no delays in response, just fast, relevant engagement.

Here’s how automation makes qualification smoother:

Lead scoring models → Rank prospects based on intent and behavior.

Chatbots → Collect essential details before agents engage.

Data sync → Unify information across systems.

Trigger-based workflows → Flag hot leads instantly and assign tasks.

By combining scoring, AI-powered pre-qualification, and automated workflows, teams can maximize conversion potential while reducing manual work. Leads move through the funnel faster, agents focus on meaningful conversations, and every prospect receives a timely, personalized response.

Once leads are qualified, it’s time to close deals. Here’s how automation speeds up B2B insurance sales from first contact to signed contract.

How can you close B2B insurance sales faster with automation?

Closing B2B insurance sales doesn’t need to drag on with endless back-and-forth emails, paperwork, and delays. The key is automating the steps that usually eat up time, so agents can focus on building trust and moving deals forward.

Here’s how to do it.

Step 1: Automate scheduling and reminders

Scheduling meetings is often the first bottleneck. Endless email exchanges and missed calls slow deals down. Automation removes this friction.

Use tools like Calendly or HubSpot Meetings so prospects book directly into your calendar.

Add automated reminders by email or SMS to cut down on no-shows.

With Strada, let prospects even schedule inside the call (“schedule conversationally”), so nothing slips.

Once scheduling runs itself, you can focus on the next major delay: paperwork and signatures.

Step 2: Streamline proposals and signatures

The second slowdown comes when it’s time to prepare, send, and sign documents. Automation turns this into a fast, seamless process.

Send digital proposals instead of paper, so no printing, scanning, or mailing.

Enable e-signatures (DocuSign, PandaDoc, HubSpot Quotes) so approvals happen in minutes.

Use AI-assisted quote generation to deliver accurate proposals fast, with risks flagged automatically.

With documents handled smoothly, you’re ready to tackle the next challenge – responding in real time when client needs change.

Step 3: React in real time with AI workflows

Customer conversations are full of signals: some showing urgency, others signaling churn. Automation with Strada ensures you never miss them.

During calls, Strada listens for risk signals (e.g., “I found a cheaper rate”) and instantly creates retention tasks.

Set trigger-based workflows in your CRM and/or AMS to alert the right rep or escalate priority accounts.

Automate next steps (follow-up emails, call scheduling, or renewal reminders), so no lead is left unattended.

With smart workflows in place, your sales team doesn’t just move faster. They react smarter, turning risks into opportunities.

Step 4: Spend time where it matters

The real goal of automation isn’t just speed. It’s freeing agents to do what technology can’t: build trust and close deals.

With scheduling, documents, and workflows automated, sales teams can focus on high-value conversations, not admin work. Every touchpoint (booking, quoting, signing) is faster, more efficient, and tracked automatically.

Closing the deal isn’t the end. Next, we’ll see how automation keeps customers happy.

What happens after the sale?

The sale isn’t the end – it’s the start of retention, loyalty, and growth. Strada keeps customers supported after day one by automating the critical post-sale touchpoints that often slow insurance teams down.

Onboarding made easy → Strada ensures new policyholders get welcome calls, documents, and account setup instantly. No manual chasing.

Seamless renewals → Strada handles proactive renewal reminders and conversational scheduling, reducing churn and keeping clients engaged.

Ongoing support & COIs → From certificate requests to renewal reminders, Strada provides quick responses and updates through automation.

Instead of scrambling with manual tasks, your team stays focused on value-driven conversations while Strada handles the rest. Post-sale processes become consistent, proactive, and customer-friendly – building satisfaction and long-term loyalty.

Once the workflows are running smoothly, it’s time to measure results and optimize.

How do you measure success and improve?

You can’t improve what you don’t measure. In insurance sales management, tracking the right metrics shows you where your funnel is strong and where it leaks.

Here are the main metrics:

Metric | What it means | Benchmark (insurance sales) |

Lead-to-quote conversion | % of leads who request/receive a quote | 20–30% |

Quote-to-bind conversion | % of quotes that turn into active policies | 25–35% (personal lines), 15–25% (commercial lines) |

Cost per lead (CPL) | Average spend to generate one lead | $40–100 (personal), $150–300 (commercial) |

Speed-to-lead | Time from lead creation to first contact | < 5 minutes (best-in-class) |

No-show rate | % of prospects who miss scheduled meetings | < 15% with reminders |

Renewal rate | % of clients renewing policies each year | 85–90%+ |

Retention/Churn | % of customers who stay vs. leave | Retention 85%+; Churn < 15% |

Customer satisfaction (CSAT/NPS) | Client-reported satisfaction score | CSAT: 80%+ / NPS: 30+ |

Tracking these allows teams to identify what’s working, where gaps exist, and how resources should be allocated. Still, metrics are critical, but mistakes can still derail results.

Let’s cover common pitfalls and how to avoid them.

What mistakes should you avoid when implementing insurance sales automation?

Automation makes insurance sales faster and more consistent, but only if it’s done right. Here are the most common pitfalls to watch for:

Over-automation → Not every task should be handled by AI. Complex cases and relationship-driven conversations still need a human touch.

Bad data → Outdated or incomplete information ruins campaigns and frustrates clients. Keep your CRM/AMS clean and synced.

Ignoring compliance → Insurance is heavily regulated. Using tools without strong security and certifications creates risk.

Missing integrations → If automation doesn’t connect to your CRM, AMS, or billing system, you’re just adding more manual work.

Avoid these mistakes, and automation becomes a growth engine, helping your team close more policies, serve clients better, and stay compliant without losing the human touch.

After mastering today’s sales automation for insurance, it’s clear how teams can scale efficiently and stay ahead. Let’s wrap up with key takeaways.

Conclusion

Insurance sales are changing fast. What used to take days (chasing quotes, scheduling calls, tracking renewals) can now happen in minutes with automation. The teams that adapt will close more deals, keep more clients, and deliver a better experience.

The ones that don’t will keep losing opportunities to speed, consistency, and customer expectations.

Strada helps insurance teams make that shift. By automating the calls, follow-ups, and renewals that slow funnels down, Strada ensures every lead is nurtured and every client feels supported, while agents focus on the conversations that really matter.

Automation isn’t about replacing people. It’s about giving your team the tools to work smarter, move faster, and stay competitive in 2026 and beyond.

If you’re ready to see how voice AI can transform your insurance conversations and workflows, join the carriers, MGAs, and brokers already scaling with Strada.

Get a demo and experience the future of insurance communication firsthand.

Frequently Asked Questions

How does automation reduce errors in insurance sales processes?

Automating insurance sales software minimizes human mistakes by handling repetitive tasks precisely. When data entry and document generation are automated, the risk of clerical errors drops significantly, improving overall accuracy and compliance.

What impact does automation have on customer response times?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How does automation improve lead management for insurance agents?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How can small insurance agencies benefit from sales automation?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

How should an insurance company start automating its sales funnel in 2026?

Framer is a design tool that allows you to design websites on a freeform canvas, and then publish them as websites with a single click.

Table of Contents

Carriers, MGAs, and brokers scale revenue-driving phone calls with Strada's conversational AI platform.

Start scaling with voice AI agents today

Join innovative carriers and MGAs transforming their calls with Strada.

Insurance Sales Automation: Automate Your Funnel in 2026

Amir Prodensky

CEO

Oct 3, 2025

11 min read

Practical steps to automate quotes, follow-ups, and renewals in 2026.

Insurance teams can’t rely on manual processes anymore.

Tracking leads in spreadsheets, juggling reminders, and manually following up with prospects slows the funnel and leaves opportunities on the table. Customers today expect instant responses, personalized conversations, and seamless service and if you can’t deliver – they’ll move on.

And the gap between rising customer expectations and outdated workflows is growing. Slow response times, missed calls, and inconsistent follow-ups all contribute to lost revenue and frustrated clients.

This is where tools like Strada, makes a difference. By automating outreach and follow-ups teams can focus on high-value conversations instead of repetitive tasks.

Because we’ve spent years helping teams streamline and automate their sales funnels, we know what actually works. And what doesn’t. This guide exists to give you a clear, ultra-practical roadmap.

No theory, just proven steps you can start using today. Here are the key things we’ll uncover together:

How to set up a modern insurance sales funnel that actually moves leads forward instead of letting them stall.

Which automation tools matter most for insurance teams in 2026 (and which ones you can skip).

How to attract, nurture, and qualify leads automatically, so you never lose momentum.

The right way to blend automation with human touch, so clients feel cared for, not spammed.

How to measure and improve your funnel over time without getting lost in data overload.

The biggest mistakes insurance teams make with automation and how you can avoid them.

By the end, you’ll have a clear playbook for building an insurance sales funnel that runs smoothly in the background, freeing your team to focus on closing deals and building relationships.

Let’s begin with the foundations.

What exactly is an insurance sales funnel?

An insurance sales funnel is the journey a prospect takes from first learning about your offerings to becoming a loyal customer. Like any funnel, it has stages that help teams understand where prospects are and how to engage them effectively.

Here are the core stages of the funnel:

Awareness → Prospects discover your company through marketing campaigns, referrals, or online search. In insurance, this might be the initial quote request or inquiry.

Interest → The prospect engages further asking questions, comparing options, or exploring coverage details.

Decision → Prospects weigh policies, costs, and value. Every interaction, from explaining policy benefits to handling objections, shapes their choice.

Action → The client buys a policy, completes payment, or signs documents.

Retention → Focus shifts to keeping customers happy through renewals and ongoing communication.

Each of these stages is a “conversation moment.”

This is exactly where Strada steps in. Its automation enhances every touchpoint: timely follow-ups, intelligent reminders, and seamless handoffs ensure no opportunity is missed. From quote intake to quote follow-ups and renewals, every interaction becomes consistent, proactive, and personalized.

Understanding the funnel, as the first step, helps highlight the gaps. Next, we’ll dive into why automation is essential to close leads faster and avoid missed opportunities.

Why should you automate your funnel?

Manual insurance sales funnels are slow, error-prone, and costly. Agents spend hours tracking leads, sending reminders, and updating spreadsheets. This leads to missed calls, dropped leads, and slower renewals.

The result? Premium leakage from prospects who never hear back, policy lapses from payment reminders that never get sent, and delays from missing documentation.

Automating the funnel addresses these challenges directly. Here’s a quick side-by-side view.

A sales automation tool for insurance reduces manual work, saving agents’ time and allowing them to focus on meaningful conversations. Instead of chasing reminders or updating spreadsheets, automation handles the repetitive tasks that slow teams down.

With the right setup, you can:

Deliver instant outreach the moment a lead comes in, so no opportunity slips through the cracks.

Log every interaction automatically, ensuring a complete record without extra admin work.

Schedule and send follow-ups at the right time, without relying on memory or manual effort.

Score and segment leads, so your agents spend time on the prospects most likely to convert.

Trigger alerts and reminders, keeping your pipeline moving without bottlenecks.

Personalize communication at scale, so every message feels tailored, not templated.

Consistency is another benefit.

Customers experience the same reliable process at every touchpoint, quotes and renewals. Lead qualification improves because automation ensures prospects are nurtured intelligently based on behavior, risk, and engagement.

This leads to higher conversion rates and better retention.

Automation also prepares teams for the digital-first landscape of 2026. Competitors leveraging intelligent workflows will outpace those relying on manual processes. Efficiency, scalability, consistency, and compliance are all outcomes of a properly automated funnel.

Сhallange | Manual funnel outcome | Strada automation impact |

Lead follow-up | Missed calls, delayed responses | Automated reminders, 24/7 follow-ups, no lead left behind |

Policy renewals | Missed deadlines, lapses | Proactive reminders, streamlined process |

Agent workload | High manual effort, risk of errors | Reduced workload, focus on high-value conversations |

Compliance & Tracking | Hard to maintain, audit gaps | All actions logged automatically, secure and compliant |

Knowing the benefits is one thing, choosing the right tools is another. Let’s look at the software that makes automation effective.

What insurance sales software should you consider?

Modern insurance teams rely on a mix of tools to manage their sales funnel efficiently:

CRMs tailored for insurance agents help track leads, policyholders, and renewals in one place, providing visibility into every interaction and automating reminders.

Marketing automation software streamlines campaigns via email, SMS, and social media, delivering targeted messages based on behavior and engagement while freeing agents from repetitive tasks.

Chatbots and virtual assistants handle FAQs, quote requests, and policy updates instantly, providing 24/7 support and escalating complex cases to human agents.

AI-driven analytics and lead scoring tools identify high-potential prospects automatically, prioritize outreach, and help teams focus on opportunities with the highest conversion likelihood.

Integration platforms, including APIs and native connectors, tie all these systems together, ensuring data flows seamlessly and workflows are automated across the entire insurance sales process.

To see how everything connects, imagine your automation toolkit as one ecosystem. Each tool plays a role, but they all need to talk to each other:

Once you know the categories of automation tools the next question is: Which specific platforms should insurers actually consider? To make this easy, we’ve broken it down into a simple, decision-ready table.

Tool | Category | Key strengths | Best for | Why it matters |

Strada | Conversational AI / Phone Automation | AI phone agents, 24/7 renewals, quote intake, integrations with AMS/CRM, enterprise-grade security | Carriers, MGAs, Brokers | Eliminates missed calls, scales revenue-driving conversations, reduces E&O risk, infinitely scalable with zero engineering lift |

HubSpot | CRM + Marketing Automation | Lead tracking, automated email/SMS campaigns, pipeline dashboards | Small to mid-size agencies needing all-in-one CRM | Provides a central hub for sales + marketing with easy automation templates |

Salesforce Financial Services Cloud | CRM + Enterprise Sales Automation | Deep insurance CRM features, advanced analytics, AI-driven lead scoring | Larger insurers with complex pipelines | Highly customizable and integrates across enterprise systems |

AgencyBloc | Insurance Agency Management System | Policy management, commission tracking, automated workflows | Independent agencies & brokers | Purpose-built for insurance workflows, combines sales + back office |

Zapier / Make | Workflow Automation | Connects 5,000+ apps, automates data handoff between systems | Teams with multiple disconnected tools | Low-code way to bridge CRMs, dialers, and marketing platforms |

Drip / ActiveCampaign | Marketing Automation | Automated email nurturing, segmentation, personalization | Agencies needing drip campaigns | Keeps leads warm automatically with minimal manual effort |

Reply.io / Salesloft | Sales Engagement Platform | Multi-channel outreach (calls, email, SMS), sequencing, analytics, cadence automation | Insurance sales teams handling high lead volumes | Improves speed-to-lead, ensures consistent follow-ups, and provides insights into rep performance |

Tableau / Power BI | Analytics & Reporting | Visual dashboards, predictive modeling, integration with CRM/AMS | Insurance teams needing deep funnel insights | Transforms raw data into clear insights, helping teams track KPIs, spot bottlenecks, and optimize funnels |

As you can see, each tool plays a role in building a complete, automated funnel, from capturing leads to nurturing, closing, and measuring results.

And Strada fits into this ecosystem as a front-office AI layer that complements existing insurance operations software. Its phone AI agents handle revenue-driving calls for carriers, MGAs, and brokers, ensuring every conversation is structured, context-aware, and actionable.

Strada isn’t just generic call automation, it’s trained on insurance terminology and built specifically for renewals and COIs.

By automating routine conversations, Strada frees human agents for high-value tasks, while integrating with CRMs and AMS platforms to sync lead and renewal data automatically.

Teams choose Strada because it is purpose-built for insurance outcomes. It’s infinitely scalable, requires no engineering lift, and integrates seamlessly with Salesforce, AMS, CRMs, and APIs. Performance is measurable: 85% of calls answered, 24/7 availability, and more cost-effective than adding human agents. Proven results highlight its value.

Fernanda Soares, Senior Manager at Tint, says:

“Leveraging Strada as a foundation, we’ve created Aimee, our AI agent, to seamlessly complement our support team. It allows us to scale with confidence, while ensuring that trust, governance, and human expertise remain central.”

Here’s why Strada stands out:

Insurance-specific intelligence → Renewals, COIs, and quote intake handled correctly every time.

Scalable operations → Handle more calls, policies, and prospects without adding headcount.

Seamless integrations → Connects with all critical systems for real-time data capture.

Reliable performance → High call-answer rates, 24/7 availability, proactive workflows.

Immediate ROI → Less manual work, fewer errors, and more revenue opportunities captured.

Combined with other sales automation tools for insurance, Strada transforms the insurance sales process from reactive to proactive. Teams gain efficiency, consistency, and predictability, while customers enjoy timely, personalized interactions.

The result is a complete, intelligent, and efficient sales ecosystem that drives measurable results, boosts conversions, and scales operations effortlessly.

With the right tools in place, attracting leads becomes much easier. Here’s how Strada and other automation solutions drive prospects into your funnel.

How do you attract leads automatically?

Manual lead generation (cold calls, scattered emails, ad hoc social posts) wastes time and delivers inconsistent results. Insurance sales automation flips the script by letting technology do the heavy lifting, while your team focuses on conversations that close deals.

Here’s the step-by-step playbook to set up a fully automated, always-on lead engine.

Step 1: Lay the foundation (the plumbing)

Before you launch campaigns, you need the pipes in place. This ensures every lead flows into your system and no opportunity gets lost.

What to do:

Add Google, Meta, LinkedIn pixels to your site.

Standardize UTM tags for every campaign.

Connect forms, chatbots, and phone lines to your CRM/AMS (HubSpot, Salesforce, AgencyBloc).

Create an instant follow-up workflow: SMS + email + call.

Launch conversion-ready landing pages for each insurance line (auto, home, commercial, benefits).

Think of this as building the pipes of your funnel, without it, automation has nowhere to flow.

Step 2: Run targeted ads with smart retargeting

Ads are the fastest way to generate demand, but without automation they leak leads. Automation makes every click count.

What to do:

Run high-intent Google search campaigns and simple quote offers.

Use Meta/LinkedIn Lead Ads to capture top-of-funnel demand.

Build retargeting buckets (1–3 days, 7–14 days, 30 days).

Route every new lead to CRM + trigger instant SMS/Strada call.

Instead of chasing down cold prospects, automation ensures hot leads hear from you while they’re still paying attention.

Step 3: Use SEO + content to attract and nurture

Ads give you speed, but content builds staying power. Automation keeps content working long after you’ve published it.

What to do:

Create pillar pages for core insurance lines.

Add gated lead magnets (renewal checklists, coverage guides).

Auto-send assets + enroll leads in nurture drips.

Repurpose content into short videos + social snippets.

With automation, your content doesn’t just educate. It continuously feeds your funnel with fresh, qualified leads.

Step 4: Automate social media presence

Social media builds trust and awareness, but posting daily is unsustainable. Automation keeps you visible without the grind.

What to do:

Schedule content across LinkedIn, Facebook, Instagram.

Use auto-DM triggers (“Comment QUOTE”) to capture info.

Sync DMs/comments into CRM automatically.

Retarget engagers with ads and nurture flows.

Instead of chasing likes, your social presence becomes a lead capture engine running on autopilot.

Step 5: Scale with referral + affiliate programs

Happy customers are your best marketers. Automation turns goodwill into a predictable stream of new business.

What to do:

Launch with ReferralRock/PartnerStack.

Offer simple rewards (gift cards, credits, rev-share).

Trigger referral invites after renewals or high NPS scores.

Auto-route referral leads into a priority queue with instant follow-up.

Instead of one-off word of mouth, referrals become a repeatable, measurable acquisition channel.

Step 6: Engage at scale with sales engagement tools

Consistency wins in sales, but it’s nearly impossible manually. Sales engagement tools automate the sequences that keep leads moving forward.

What to do:

Build multi-channel cadences (call with Strada + email + SMS with Strada).

Segment sequences by product line or persona.

Track engagement analytics to refine messaging.

Sync outreach with your CRM so no activity is lost.

These platforms ensures every prospect gets the right number of touches at the right time, without relying on memory or sticky notes.

Step 7: Supercharge conversations with Strada

The phone is still central to insurance conversations. Strada’s conversational AI ensures quote and renewal calls happen instantly, accurately, and at scale.

What to do:

Deploy AI phone agents for quote intake and renewals.

Trigger outbound calls the moment a new lead arrives.

Log calls + transcripts back into CRM/AMS automatically.

Use intelligent retries + caller ID optimization to maximize pickup rates.

With Strada, phone conversations (the lifeblood of insurance sales) become faster, smarter, and infinitely scalable.

Step 8: Track with analytics + feedback loops

What gets measured gets improved. Analytics tools turn your funnel from a black box into a predictable growth engine.

What to do:

Use Tableau/Power BI for dashboards and predictive insights.

Track cost per lead, speed-to-lead, contact rates, and closed policies.

Push closed-won data back into ad platforms for smarter targeting.

Review funnels every 90 days and refine.

With analytics in place, you’re not guessing which campaigns work. You know exactly where to double down.